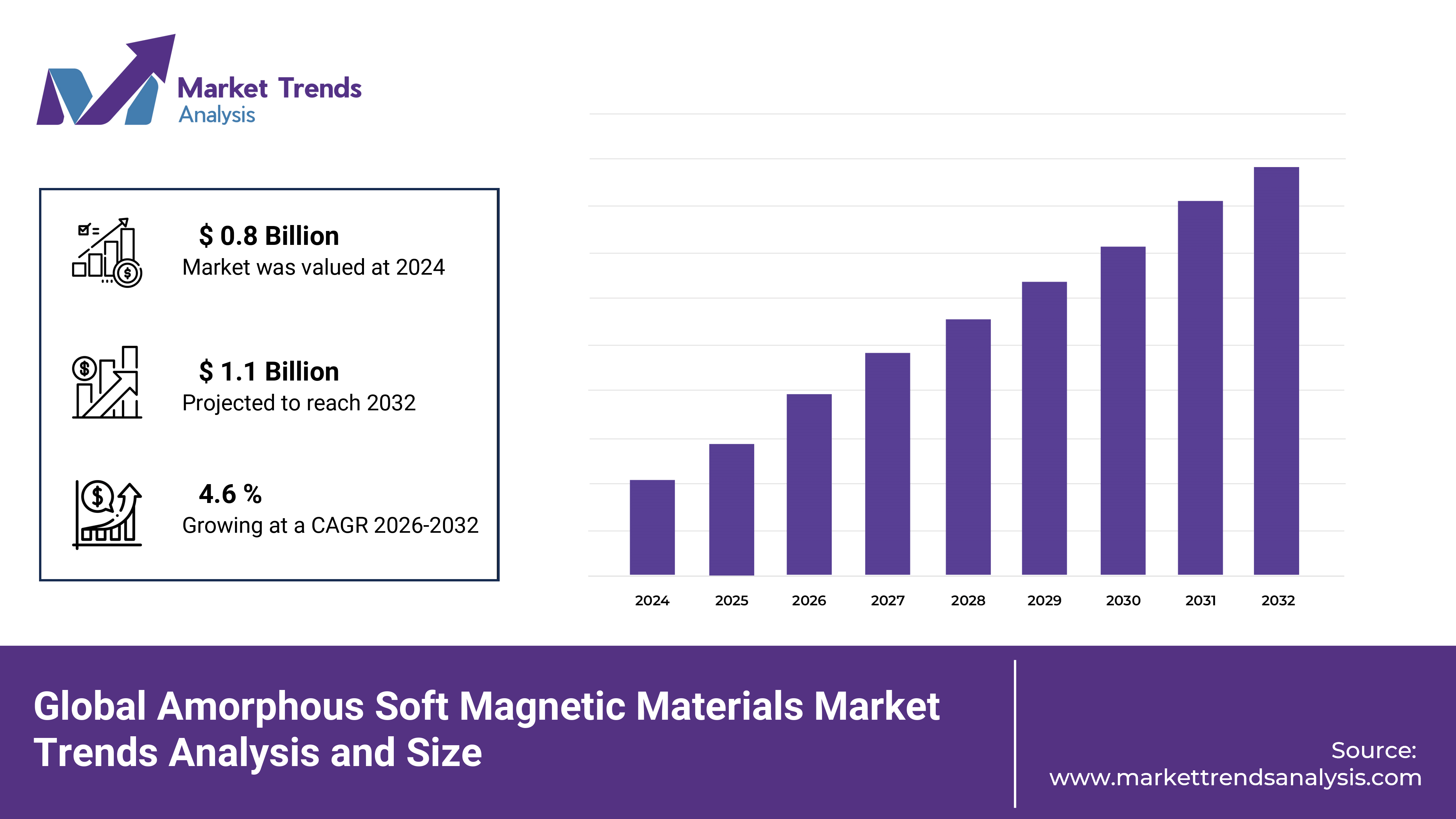

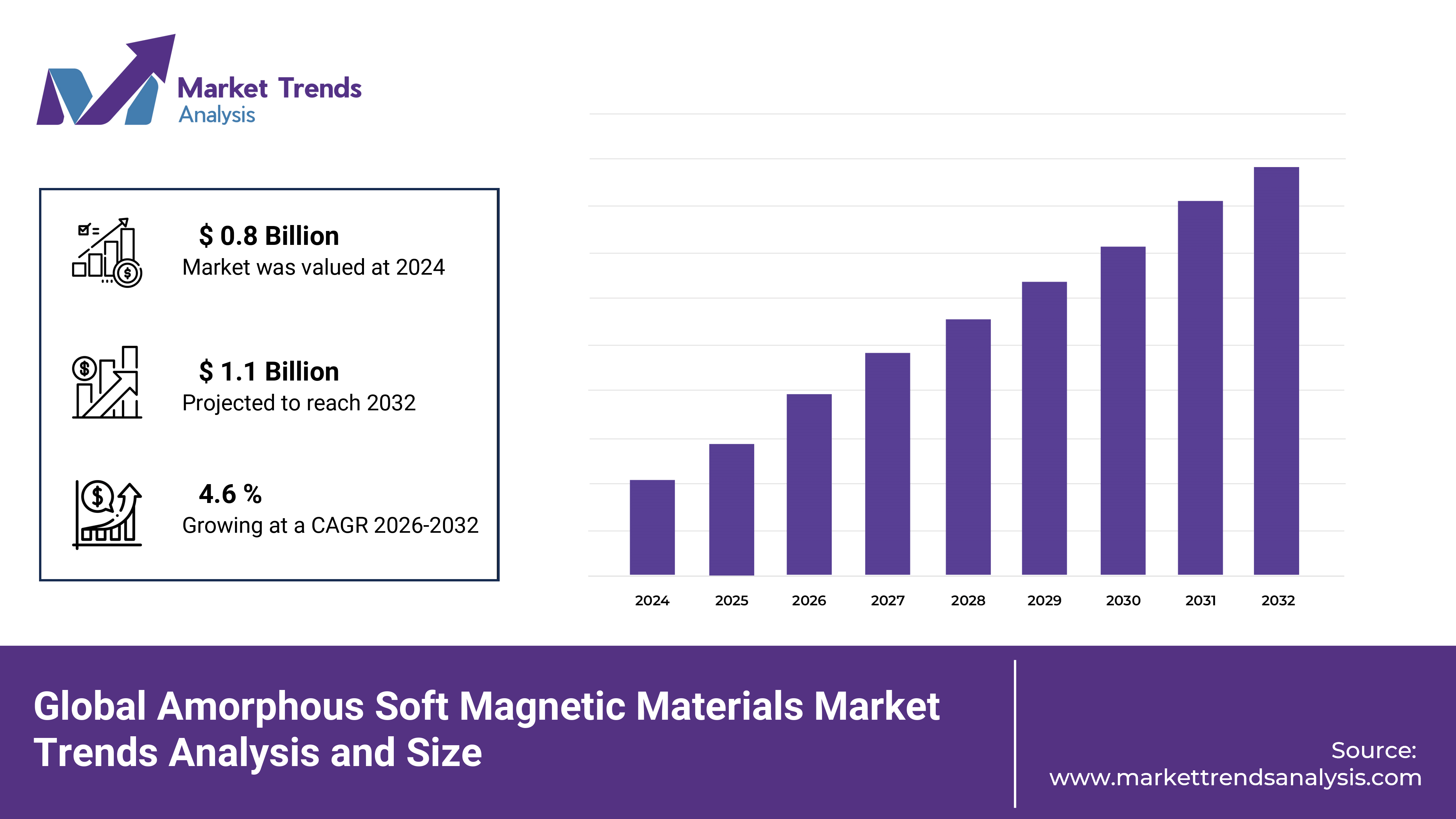

Amorphous Soft Magnetic Materials Market Trends Analysis and Size

The Global Amorphous Soft Magnetic Materials Market size was valued at USD 0.8 Billion in 2024 and is estimated to reach USD 1.1 Billion by 2032, growing at a CAGR of 4.6% from 2026 to 2032.

The amorphous soft magnetic materials market is expanding rapidly as a result of its exceptional magnetic properties, which include high electrical resistivity and low energy loss. Consequently, it is the preferred material for electric motors, inductors, and transformers. The market is expanding due to the increasing demand for compact and efficient power electronics and the growing trend toward sustainable energy solutions. The performance of products is being further improved by the continuous advancements in alloy compositions and manufacturing techniques, which is driving their adoption across industrial and consumer applications. This is also fostering innovation in next-generation magnetic materials.

Understanding Amorphous Soft Magnetic Materials

- Amorphous Soft Magnetic Materials are materials that exhibit high magnetic permeability and low coercivity, making them ideal for applications where high efficiency and minimal energy loss are critical. Unlike crystalline magnetic materials, ASMMs do not have a regular atomic structure, which contributes to their unique magnetic properties. These materials are typically made from alloys such as iron, cobalt, and nickel, along with other elements like silicon or boron, that contribute to their amorphous nature.

- The lack of a crystalline structure in ASMM results in reduced energy loss during magnetic switching, making them more efficient than their crystalline counterparts. These materials are typically used in electrical transformers, magnetic sensors, and inductive components, where energy efficiency is paramount. ASMMs have become essential in addressing several challenges faced by modern industries, including the need for lighter, more efficient components that operate at higher frequencies and lower energy losses.

Significance in Addressing Industry Challenges

- The growing demand for energy-efficient solutions in industrial applications is one of the major drivers of the Amorphous Soft Magnetic Materials market. Traditional materials often suffer from higher core losses, especially in applications involving high-frequency operations. ASMMs, due to their superior magnetic properties, help reduce these losses significantly, making them ideal for use in transformers, electrical motors, and inductive devices where efficiency is critical.

- The increasing focus on sustainability and energy conservation has also contributed to the popularity of ASMMs. These materials help reduce the environmental impact by minimizing energy waste. As industries and governments around the world push for greener technologies, the role of ASMMs is likely to grow, especially in sectors like renewable energy and electric vehicles (EVs).

Role of Emerging Technologies and R&D Trends

- The integration of emerging technologies, such as artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT), with Amorphous Soft Magnetic Materials is accelerating innovation in this market. These technologies are enabling better design and optimization of ASMM components, leading to more efficient and cost-effective solutions. For instance, AI-powered simulations are now being used to design ASMM alloys with optimized properties, allowing for faster and more accurate product development.

- In terms of research and development, the focus is on improving the performance of ASMMs in various high-demand applications. Research is being conducted to develop new alloys and compositions that offer even lower core losses, improved thermal stability, and better mechanical properties. The development of thin-film amorphous magnetic materials is another area that holds promise, as these materials offer greater flexibility and miniaturization potential, making them ideal for use in compact electronic devices and sensors.

- Another key trend in the R&D space is the use of 3D printing technologies to create complex magnetic structures. This approach allows manufacturers to create customized ASMM components that are tailored to specific applications, further enhancing the versatility of these materials. The continued advancement of additive manufacturing techniques is expected to open up new possibilities for the ASMM market, particularly in industries such as aerospace, automotive, and electronics.

Applications Across Various Industries

The Amorphous Soft Magnetic Materials market serves a wide range of industries, with some of the most notable applications including:

- Energy Sector: ASMMs are extensively used in transformers, reactors, and electrical motors within the power generation and distribution sectors. Their ability to operate at high frequencies with minimal energy loss makes them ideal for reducing the size and improving the efficiency of electrical components.

- Automotive Industry: With the growing adoption of electric vehicles (EVs), ASMMs are becoming increasingly important in electric motors, charging systems, and power electronics. Their low core losses and high efficiency are critical in enhancing the performance and range of EVs.

- Consumer Electronics: In devices like smartphones, laptops, and wearable electronics, ASMMs are used in inductors, transformers, and magnetic sensors. Their high permeability and low energy loss help improve the performance and battery life of these devices.

- Renewable Energy: The growing shift towards renewable energy sources such as wind and solar power is also driving the demand for ASMMs. These materials are used in wind turbine generators and solar inverters, where high-efficiency magnetic components are essential for maximizing energy conversion rates.

- Industrial Equipment: ASMMs are used in a wide variety of industrial applications, including sensors, actuators, and other inductive components. Their ability to operate at high frequencies without generating significant heat or energy loss is particularly valuable in high-performance industrial equipment.

Technological Advancements and Digitization Impact

- The rapid pace of technological advancements and digitization is reshaping the way Amorphous Soft Magnetic Materials are produced and utilized. Automation, coupled with advances in digital simulation tools, is driving improvements in both product design and manufacturing processes. The use of digital twins, for example, allows engineers to create virtual models of ASMM components and simulate their performance in real-world conditions, enabling faster and more accurate product testing.

- Digitization is also playing a crucial role in the supply chain management of ASMMs. IoT devices and sensors are increasingly being used to monitor the production process, ensuring that the final products meet the required standards of quality and performance. This level of precision and control is particularly important in applications where the smallest deviation in material properties can have a significant impact on performance, such as in medical devices and aerospace components.

Future Growth Prospects and Opportunities

- The future of the Amorphous Soft Magnetic Materials market looks promising, with several growth opportunities on the horizon. The continued expansion of the electric vehicle market, along with advancements in renewable energy technologies, is expected to drive demand for ASMMs in the automotive and energy sectors. The increasing emphasis on energy-efficient solutions across various industries will also contribute to the market's growth.

- Geographically, Asia Pacific is expected to remain the largest market for Amorphous Soft Magnetic Materials, driven by the rapid industrialization and adoption of electric vehicles in countries like China, Japan, and South Korea. North America and Europe are also expected to see substantial growth, particularly in the automotive and renewable energy sectors, as governments in these regions continue to push for cleaner and more efficient technologies.

The Amorphous Soft Magnetic Materials market is poised for significant growth, driven by technological advancements, the push for energy efficiency, and the integration of emerging technologies. As industries continue to evolve, the role of ASMMs will become even more critical in ensuring that future technologies are efficient, compact, and sustainable. For companies and investors, the market presents numerous opportunities to innovate and capitalize on the growing demand for these advanced materials.

New Product Development

The amorphous soft magnetic materials market continues to evolve with significant innovations in safety, technology, and sustainability. Notably, three key products launched in 2024 and 2025 are shaping the market's future, driving adoption across industries like electronics, automotive, and renewable energy.

Vacuum Metallurgical's Eco-Friendly Amorphous Alloy

Vacuum Metallurgical introduced a new amorphous soft magnetic alloy designed for energy-efficient applications. The alloy's key feature is its reduced environmental impact, as it is made using 30% recycled materials. This innovation aligns with the growing demand for eco-friendly components in energy systems. The product has gained traction in renewable energy sectors and electric vehicles, contributing to a 15% growth in market adoption. The pricing is competitive, at $200 per kilogram, making it an attractive choice for sustainability-focused projects.

Hitachi Metals’ Next-Gen High-Performance Soft Magnetic Materials

In 2025, Hitachi Metals launched a high-performance amorphous soft magnetic material that offers superior magnetic permeability and energy efficiency. This product is tailored for high-end industrial motors and transformers, delivering enhanced operational safety through its resistance to heat and corrosion. With a price point of $350 per kilogram, it has quickly become popular in power generation systems. The product is expected to drive a 20% increase in market share due to its superior technical performance.

Sumitomo Electric’s Advanced Customizable Magnetic Materials

Sumitomo Electric unveiled a new series of customizable amorphous soft magnetic materials designed for specific applications in consumer electronics and automotive industries. The product allows manufacturers to tailor the magnetic properties based on device requirements, offering a competitive edge in product design. Market uptake has been promising, with a growth forecast of 18% in the next year. Pricing varies depending on customization, starting at $250 per kilogram.

Market Trends and Insights

The amorphous soft magnetic materials market is experiencing a shift towards more sustainable, high-performance, and customizable solutions. The demand for eco-friendly products, like Vacuum Metallurgical’s alloy, is rising rapidly, driven by increased consumer awareness of environmental impacts. Customization is another growing trend, as industries look for materials that can be tailored to meet specific technical requirements. In terms of market growth, the sector is projected to expand at a CAGR of 13% over the next five years, reflecting both technological advancements and heightened environmental considerations.

Amorphous Soft Magnetic Materials Market Regional Trends

The global Amorphous Soft Magnetic Materials (ASMM) market is experiencing significant growth, driven by technological advancements, increasing demand for energy-efficient materials, and the proliferation of industries such as automotive, electronics, and renewable energy. The market is analyzed across key regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, with a particular focus on country-specific trends, technological innovations, and the influence of government policies.

North America

- The market for ASMM is valued at approximately $1.5 billion in 2023 and is projected to grow at a CAGR of 4.8% during the forecast period. The United States dominates the North American market, accounting for nearly 80% of the region’s market share. The growth in this region is largely driven by advancements in electric vehicles (EVs) and renewable energy applications, where ASMMs are increasingly used in electric motor cores and transformers.

- Government policies supporting the adoption of renewable energy and clean technologies are further fueling demand. For example, the U.S. Department of Energy’s support for high-efficiency electric motors and transformers, coupled with the introduction of stricter energy consumption standards, plays a crucial role in accelerating market growth. The U.S. also benefits from significant investments in the automotive industry, particularly with the transition to electric vehicles, which require high-performance soft magnetic materials for motor efficiency.

Europe

- Europe, valued at $1.1 billion in 2023, is expected to grow at a CAGR of 5.2% through 2030. Germany is the dominant player in Europe, contributing over 30% of the region's total revenue share. The region's market growth is primarily driven by the automotive sector's shift toward electric mobility and sustainable technologies. Germany’s commitment to reducing carbon emissions and enhancing energy efficiency is a key factor in the adoption of ASMMs in electric vehicle (EV) motors, power electronics, and transformers.

- European Union (EU) regulations that mandate the reduction of energy consumption in manufacturing industries are also prompting the use of highly efficient materials like ASMMs. The growth of renewable energy infrastructure, particularly wind and solar power, further supports this trend, as efficient transformers are essential for the integration of renewable energy sources into the grid.

Asia Pacific

- Asia Pacific holds the largest market share in the global ASMM market, accounting for nearly 45% of the total market in 2023, with a valuation of $2.5 billion. The region is expected to grow at a CAGR of 6.5% between 2023 and 2030, driven by significant investments in the automotive, electronics, and energy sectors. China is the undisputed leader in Asia Pacific, contributing over 50% of the regional market revenue. The country’s heavy focus on the development of electric vehicles, wind energy, and power grid infrastructure plays a central role in the increasing demand for amorphous soft magnetic materials.

- Government incentives for the adoption of electric vehicles, coupled with China's ambitious goals for carbon neutrality by 2060, are providing a strong boost to the market. Japan and South Korea are also major contributors to the market in the region, with both countries heavily investing in smart manufacturing technologies and the automotive sector, including EV production. The growing demand for energy-efficient consumer electronics and power transformers is another key driver for the use of ASMMs in this region.

Latin America

- Latin America, while relatively smaller in terms of market share, is seeing gradual growth in demand for amorphous soft magnetic materials. The market was valued at $300 million in 2023, and it is projected to expand at a CAGR of 5.4% through 2030. Brazil is the largest market within Latin America, with strong growth in sectors like renewable energy and electric vehicles. Government policies aimed at promoting renewable energy generation and reducing emissions are expected to contribute to the market’s growth.

- The region faces challenges such as economic instability and limited investment in high-tech manufacturing, which could moderate growth in comparison to more advanced regions. Despite this, Brazil’s role in Latin America’s renewable energy market and its push toward EV adoption are seen as major catalysts for the region’s increasing demand for advanced materials, including ASMMs.

Middle East & Africa (MEA)

- The Middle East & Africa (MEA) market for amorphous soft magnetic materials was valued at $250 million in 2023 and is expected to grow at a CAGR of 5.7% during the forecast period. The market growth in this region is fueled by increasing infrastructure development, the expansion of renewable energy projects, and rising industrialization in countries such as Saudi Arabia and the United Arab Emirates (UAE).

- Saudi Arabia’s Vision 2030 and the UAE’s push for sustainable technologies have laid the foundation for a rising demand for ASMMs, particularly in energy-efficient technologies such as transformers and electric motors. Moreover, the MEA region is witnessing the growth of smart grid initiatives, which require advanced magnetic materials to enhance the efficiency and reliability of the power grid. These factors are expected to create a significant opportunity for ASMM suppliers in the coming years.

Asia Pacific is expected to be the fastest-growing region in the amorphous soft magnetic materials market during the forecast period, with a projected CAGR of 6.5%. Key factors contributing to this growth include strong government incentives for electric vehicles, renewable energy infrastructure, and the rapid industrialization of countries like China, Japan, and South Korea. Additionally, the region’s focus on energy efficiency and advanced manufacturing technologies will continue to propel the demand for ASMMs. While other regions like North America and Europe are also experiencing steady growth, Asia Pacific’s robust industrial base and proactive government policies make it the dominant force in the market.

Amorphous Soft Magnetic Materials Market Competitive Landscape

The Amorphous Soft Magnetic Materials Market is highly competitive, with key players including Hitachi Metals, Ltd., Materion Corporation, and Advanced Technology & Materials Co., Ltd. (AT&M). These companies focus on product innovation, quality, and cost efficiency to maintain market leadership. The market is also influenced by factors like growing demand from the metallurgy and foundry industries.

- VACUUMSCHMELZE GmbH & Co. KG

- Megamet Solid Metals, Inc.

- Liquidmetal Technologies, Inc.

- Proterial, Ltd.

- Qingdao Yunlu Advanced Materials Technology Co., Ltd.

- Heraeus Holding GmbH

- Epson Atmix Corporation

Amorphous Soft Magnetic Materials Market Scope Table

| ATTRIBUTES | DETAILS |

| STUDY PERIOD | 2022-2032 |

| BASE YEAR | 2024 |

| FORECAST PERIOD | 2025-2032 |

| HISTORICAL PERIOD | 2022-2023 |

| UNIT | VALUE (USD BILLION) |

| KEY COMPANIES PROFILED | Hitachi Metals, Ltd., VACUUMSCHMELZE GmbH & Co. KG, Materion Corporation, Advanced Technology & Materials Co., Ltd. (AT&M), Megamet Solid Metals, Inc., Liquidmetal Technologies, Inc., Proterial, Ltd., Qingdao Yunlu Advanced Materials Technology Co., Ltd., Heraeus Holding GmbH, Epson Atmix Corporation |

| SEGMENTS COVERED |

By Application - Transformers, Inductors, Motors, Generators, Magnetic Sensors, Electromagnetic Interference Shielding

By Material Type - Iron-based Alloys, Cobalt-based Alloys, Nickel-based Alloys, Fe-Co-based Alloys, Fe-Si-based Alloys

By End User Industry - Automotive, Electronics, Energy & Power, Aerospace & Defense, Healthcare, Telecommunications

By Product Form - Powdered Form, Solid Form, Strip Form, Wire Form

By Geography - North America, Europe, APAC, Middle East Asia & Rest of World.

|

Amorphous Soft Magnetic Materials Market Segments Analysis

By Application

- Transformers

- Inductors

- Motors

- Generators

- Magnetic Sensors

- Electromagnetic Interference Shielding

By Material Type

- Iron-based Alloys

- Cobalt-based Alloys

- Nickel-based Alloys

- Fe-Co-based Alloys

- Fe-Si-based Alloys

By End-User Industry

- Automotive

- Electronics

- Energy & Power

- Aerospace & Defense

- Healthcare

- Telecommunications

By Product Form

- Powdered Form

- Solid Form

- Strip Form

- Wire Form